Last week The Tennessee Star asked State Sen. Paul Bailey, chair of the Senate Transportation Committee and general manager and vice-president of Charles Bailey Trucking Company, about the possible impact Gov. Haslam’s proposed gas tax increase will have on Pilot Flying J’s business operations and whether it would be in the public interest to have a full and open discussion in a committee hearing about this issue.

Pilot Flying J, the fourteenth largest privately held company in the country, owns and operates more than 500 gas and diesel truck stops around the country, approximately 40 of which are in the state of Tennessee.

The Haslam family owns Pilot Flying J, and Gov. Haslam, while not involved in the operation of the business, has a significant equity interest in the company, though he has never fully disclosed the exact amount of that interest.

While supportive of discussing the general issue of whether the “float” that unremitted fuel taxes benefit a fuel supplier, Sen. Bailey raised the additional question of exactly when the taxes collected are paid to the Tennessee Department of Revenue:

“The payer of these taxes remit payment to the state upon delivery to their terminals; therefore, the only ‘float’ comes to the benefit of the state which is paid before fuel products are actually sold to end users.”

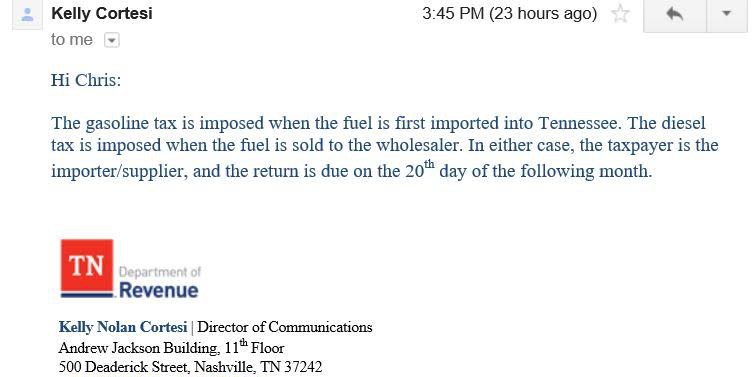

The following day, The Star sent Kelly Cortesi, Director of Communication for the Tennessee Department of Revenue the statement provided by State Sen. Bailey and asked for confirmation:

“The Dept. of Revenue’s website says that the fuel taxes are not due to the state until 20 days after the month in which the fuel is sold.

Can you please explain.”

Ms. Cortesi promptly replied:

“The gasoline tax is imposed when the fuel is first imported into Tennessee. The diesel tax is imposed when the fuel is sold to the wholesaler. In either case, the taxpayer is the importer/supplier, and the return is due on the 20th day of the following month.”

A straightforward reading of what is posted on the state’s Department of Revenue website as confirmed by Ms. Cortesi is that between the time when the tax is incurred as opposed to the time the taxes are remitted with the tax return to the state, that money is retained by the importer/supplier anywhere from 20 to 51 days depending on the month.

A straightforward reading of what is posted on the state’s Department of Revenue website as confirmed by Ms. Cortesi is that between the time when the tax is incurred as opposed to the time the taxes are remitted with the tax return to the state, that money is retained by the importer/supplier anywhere from 20 to 51 days depending on the month.

Two different answers to the same question. But a question nonetheless that has been raised concerning a possible conflict of interest for the Governor’s fuel tax plan because of his equity holding in his family’s privately held Pilot Flying J, a company that is both a distributor and retailer of gas and diesel fuel.

It is also a question that can be easily and publicly answered should either the House or Senate Transportation Committees invite representatives from both the Tennessee Department of Revenue and Pilot to answer in public testimony.

[…] month,” Kelly Cortesi, director of communications for the Tennessee Department of Revenue told the Tennessee […]

Ever notice that the big name truck stops- Pilot Flying J, TA, Petro, etc. prices for diesel is twenty to thirty cents a gallon higher than smaller retailers. They pump far more volume than the smaller stores and are the highest.

[…] you confirm that suppliers and retailers of both gas and diesel can hold the tax money anywhere from 20-51 days depending on the month before remitting to state per dept. of revenue fuel tax […]

[…] Look likely that Haslam’s Gas Tax will directly benefit his Pilot gas station empire. https://tennesseestar.com/2017/02/27/dept-of-revenue-confirms-pilot-flying-j-will-hold-on-to-extra-ca… […]

Haslam is wanting to raise the gas tax. Something is seriously wrong with this proposal.

Raising the gas tax does not help Pilot. If it does someone please explain to me how it does.

Think about the interest they stand to make by holding the collected tax for 20 to 51 days.I’d take it.john

Thank you for following up on the questionable motivation of our Governor proposing a tax on GASOLINE AND DIESEL FUEL…whose family owns a chain of truck stops AND whose main business is to buy and sell, well… GASOLINE AND DIESEL FUEL. Don’t ya think the question in every Tennessean’s mind should be “What could go wrong?”

The Gov has a lot of hubris proposing this tax while the family business, his brother (and possibly the Gov himself) are still under investigation by the DOJ and the FBI for fraud by cheating truckers out of their fuel rebates. The poorest Tennesseeans (rural dwellers who will pay the most since they drive 30% more than their urban counterparts and will pay more for goods trucked to rural areas) – will suffer the most under the Gov’s proposed tax scheme. Are the poorest of TN taxpayers the next target of another Pilot scam?

http://www.irontontribune.com/2013/07/08/fbi-links-governor-to-pilot-j/

http://www.foxnews.com/politics/2014/07/14/feds-company-co-owned-by-tennessee-gov-bill-haslam-to-pay-2-for-cheating.html